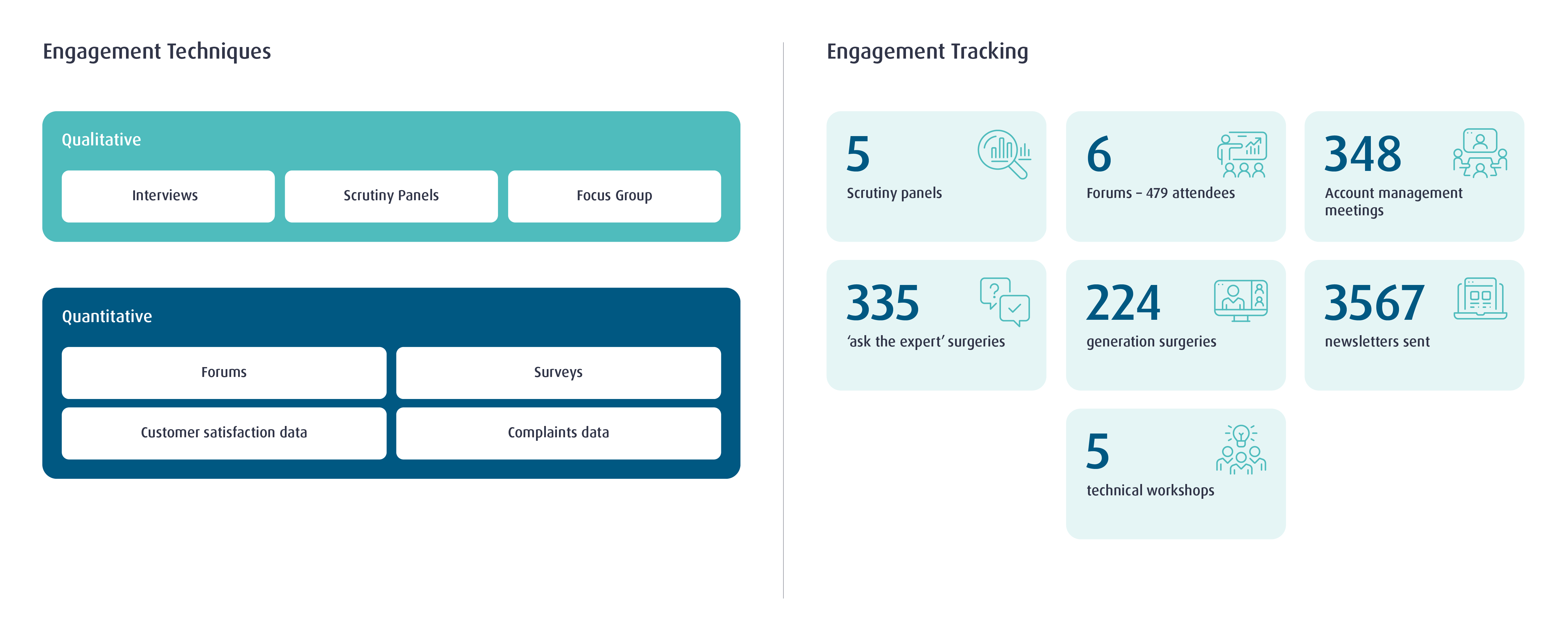

We have a range of mechanisms to engage with customers to better understand their needs, develop appropriate products and services and to ensure we are maximising the customer satisfaction that we deliver. We use a combination of quantitative and qualitative mechanisms to understand our customer needs. We track all of our customer interactions and resulting actions in our Customer Relationship Management (CRM) system.

Major Connections Incentive

Our Major Connections Annual Report (MCAR) brings together our service improvement plan that we have co-designed with our customers and wider stakeholders and our performance within each regulatory year of RIIO-ED2 (2023 – 2028).

This plan is designed to be a living document and will be regularly updated. Your feedback on both the quality of the plan and the structure of our report is welcome.

I am delighted to be able to share our Major Connections performance and service improvement plan with you for the regulatory period 2023 – 2028. This, collectively, is known as our Major Connections Annual Report and replaces the Incentive on Connections Engagement (ICE) which ran from 2015 to 2023. Our service improvement plan could not be developed without your valuable input; thank you for your continued support in helping us improve our service to you.

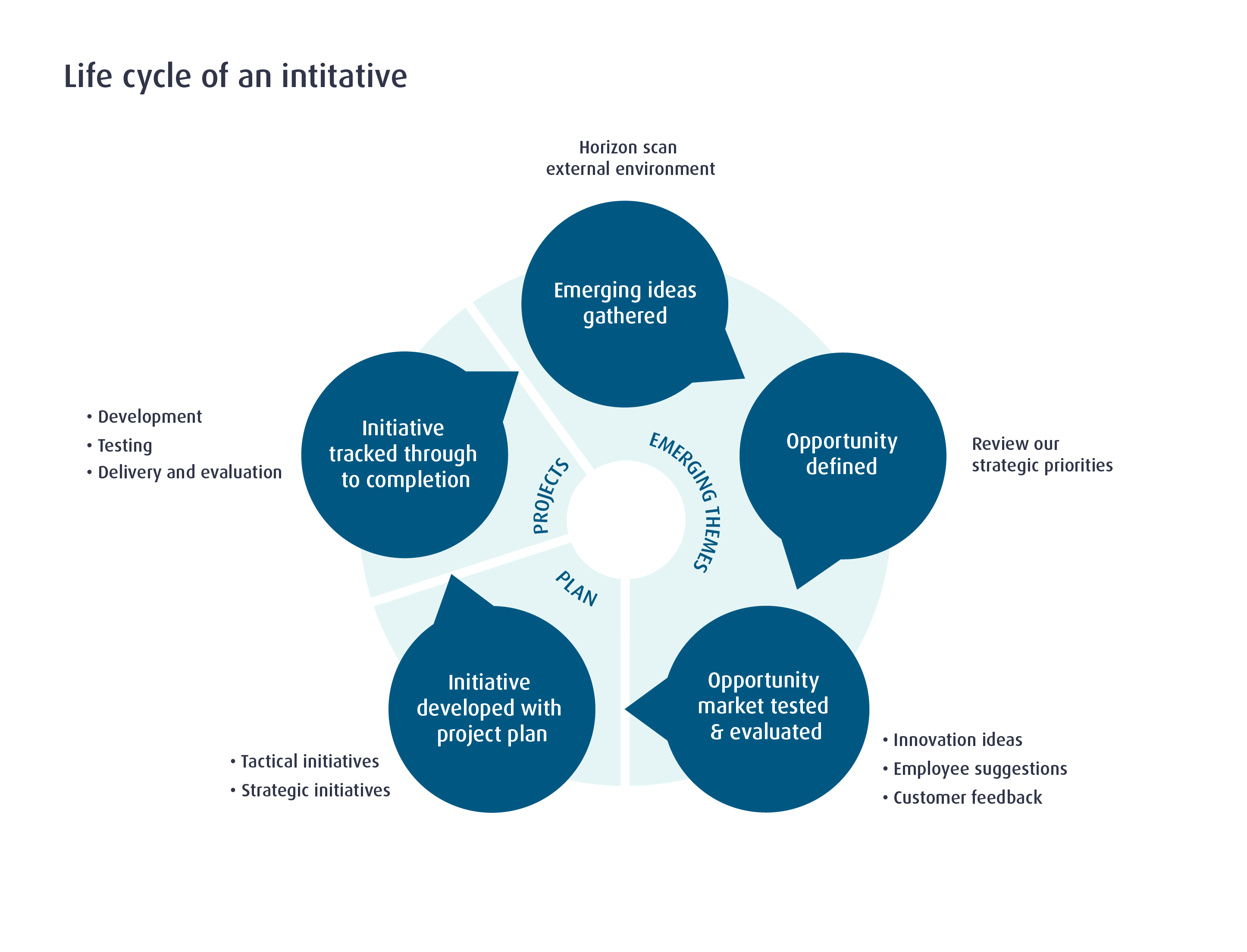

The initiatives that we have developed with you reflect both the challenges and opportunities that decarbonisation, digitalisation and emerging constraints on the transmission network are posing the industry. Our plan is dynamic, and we will adapt our products and services to meet the changing market. That is one of the reasons for sharing our plan as an interactive website, it is not a static report that we produce once a year.

We have given you opportunities to provide feedback throughout this website and of course at our regular forums, seminars, scrutiny panels and one-to-one meetings.

Alternatively drop me or my team a line, I would welcome your feedback.

Mark Adolphus

Director of Connections and Sustainability

Our strategy

Managing network constraints

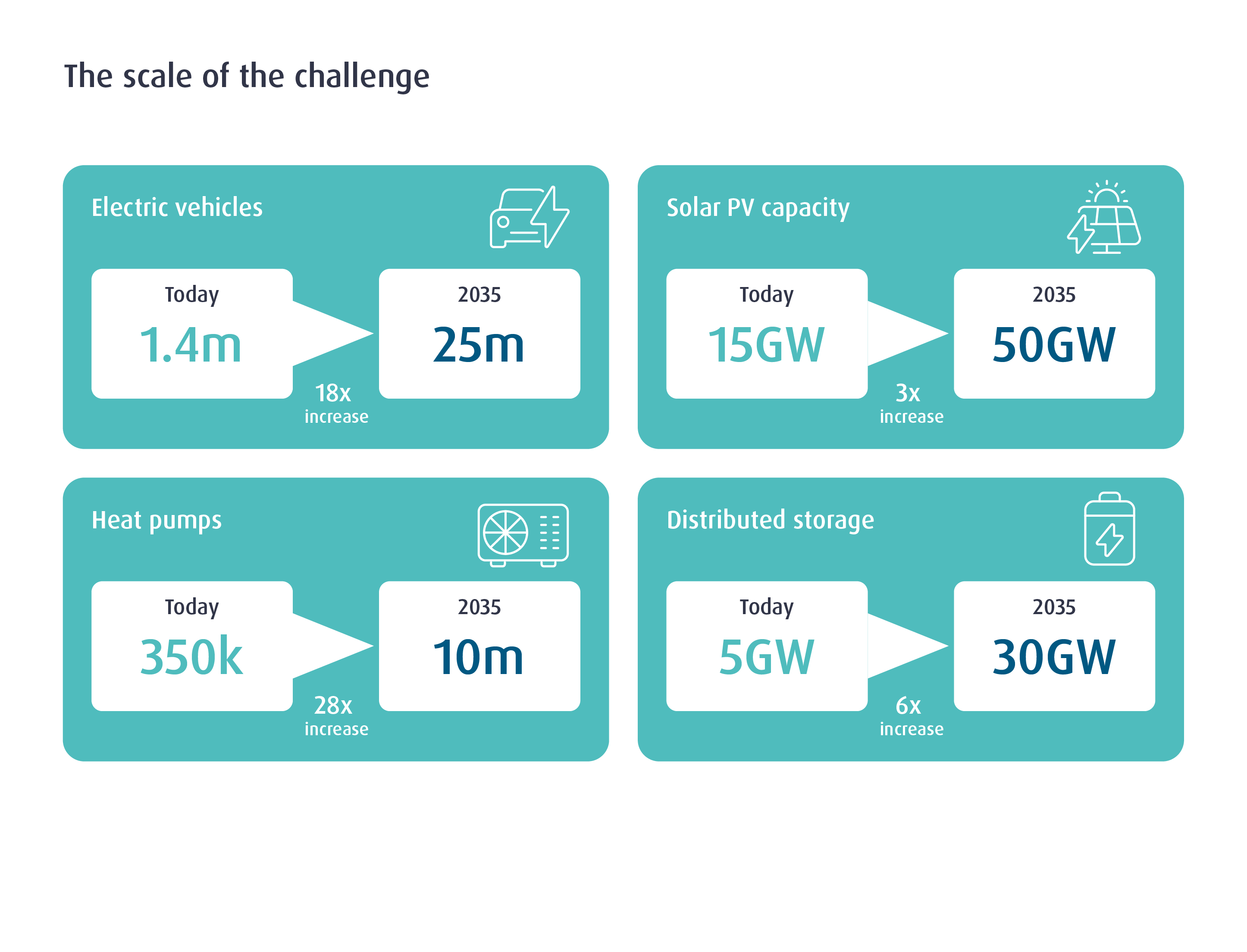

The decarbonisation of the UK grid has been a success story but there is still more to do. National Grid’s Future Energy Scenarios suggest solar capacity is forecast to increase from 15GW to 50GW and distributed storage from 5GW to 30GW by 2050.

The complication:

- The ‘queue’ of customers looking to connect to the network to provide generation capacity is over 700GW, more than double what the ESO forecasts will be required to facilitate Net Zero.

- Significant reinforcement is required on the Transmission Network to facilitate new generation connections, some of which will take more than a decade to deliver.

Our solution:

- Work with customers and stakeholders to identify projects in the queue that are ready to connect and remove those that are not progressing.

- Provide innovative commercial and technical solutions to enable those customers to connect early while transmission reinforcement is being undertaken.

Decarbonising heat and transport

Electricity networks will need to cater for a doubling of demand by 2035. The decarbonisation of transport is well under way and the decarbonisation of heat is accelerating. All new build homes will be electric by the end of the decade likely supported by solar and battery storage.

The complication

- Given the scale of distribution networks, our challenge is to understand where, when and how much capacity is required to facilitate this demand to avoid misdirected or wasteful investment and unnecessary costs for customers.

- The range of customers looking to decarbonise is diverse and the pace of technological change increasing.

Our solution

- Involve our customers in innovation projects to identify the commercial and technical solutions of the future.

- Provide Open Data to empower customers to make their own decisions about when and where to connect.

- Work with industry trade bodies to develop products, policies and processes that support specific segments looking to accelerate decarbonisation.

Exploiting data

In UK Power Networks all data is presumed open. Our customers and stakeholders are becoming more sophisticated in their use of data. Competition has flourished in the connections market to the extent that customers can now design, deliver and audit their own connections.

The complication

- The depth, breadth and quality of our data is improving but there are still gaps in our data provision particularly at the lower voltages where most customers connect.

- Not all customers are able to manipulate the raw data in a way that helps them make decisions about their connection.

Our solution

- Improve the quality of our data with a combination of record digitisation, physical monitoring and AI led data modelling.

- Combine data sets to support customers with particular use cases to enable them to plan their connections more quickly and efficiently.

We engage with a variety of customers and stakeholders both on their immediate power requirements and their long-term strategies. Our customers help us design new products and services and partner with us on innovation programmes. Independent Distribution Network Operators (IDNOs) and Independent Connection Providers (ICPs) are an integral part of the connections marketplace and important stakeholders. This year we have been building relationships with a broad range of businesses and public bodies looking to develop their decarbonisation strategies. We are working closely with some of the larger trade bodies such as Logistics UK, the BVRLA and Charge UK to reach as many potential customers as possible with a consistent message and approach.

We understand that different markets have different characteristics. We align with Ofgem’s segmentation and ensure that we are addressing the needs of each group in our service improvement plan.

Metered: Customers who connect, move or upgrade their power supply for their business premise or development project.

ICPs and IDNOs: Independent Connection Providers (ICPs) or Independent Network Operators (IDNOs) managing and delivering their connections activity.

Highway services: Customers who connect streetlights and street furniture, including EV charge points, in the public highway.

Distributed generation: Customers who connect a variety of generation technologies to our network including solar, wind and storage. This segment is also referred to as Distributed Energy Resources (DER).

The pace of change in the energy sector is accelerating. With our RIIO-ED2 Business plan as our starting point, we review our strategy with our staff and customers on an annual basis and adjust our priorities accordingly. It is important to us that our staff, customers and wider stakeholders co-design our initiatives and are involved in build, test and deployment.

It is important that we can demonstrate that our plan meets regulatory requirements as well as our customer needs. We have mapped the actions we committed to in our RIIO-ED2 Major Connections strategy to the initiatives that we developed in the year.

| Strategy reference | Major Connections Strategy – published actions | Specific target | Actions and initiatives delivered 2023/24 |

|---|---|---|---|

| A | Provision of API-format digitised network locational / GIS data as well as identification of future available capacity on assets down to high-voltage feeders, based on existing and committed connections, updated monthly, identifying any areas of network constraint and possible future flexible connection options.

This may be supported with graphical representation of data, such as via heat maps, and longer-term planning indicators, such as long-term development statements. |

Data presented as described by the end of the RIIO-ED2 period.

Much of this information will be available before this as our digital platform evolves. |

Open Data Portal data sets published include:

Associated initiatives:

|

| B | Provide clear support to all types of customer in accessing knowledge and services associated with connections. This support will include clear guides on connections journeys, metered and unmetered, how to access these services and how to gain further support in the connections process. Connections journeys will be clearly set out and choices available to customers will be explained along with any information requirements. | Part of connection service survey questionnaire feedback – overall score >93% | 88% Customer Service satisfaction in regulatory year 2023/24

Associated initiatives:

|

| C | Offer connections services to support connections and streamline the initial connections application.

This will include Ask-the-Expert, 1-to-1 and group surgeries, feasibility studies and will be developed through RIIO-ED2 jointly with customers to ensure needs are met. |

Score of at least 93% satisfaction from surveys of these services. | 90% Ask the Expert’ satisfaction 96% ‘Surgery’ satisfactionAssociated initiatives:

|

| D | Manage a comprehensive plan to engage with all potential connections services customers. This will include stakeholder review for a aligned to key connections themes, scrutiny panel reviews, DFES requirements capture, survey feedback on evolving connections strategic plan, multi-channel periodic updates on services and any further wider engagement developed through RIIO-ED2. | Evidence of published, evolving strategy and customer feedback.

Score of at least 93% satisfaction from surveys of these services. |

94% Forum satisfaction 90% ‘Ask the Expert’ satisfaction 96% ‘Surgery’ satisfaction

|

| E | Ensure customers are fully engaged in choices/options to reduce cost and/or delivery timescales and that a comprehensive description of scope and cost-breakdown are provided. This could include reviewing original requirements, identifying efficiencies during delivery, such as collaboration with other site or wider excavation activities, and timely management of scope variations. As part of this initiative, customers will be nominated a point of contact throughout the connections journey. On completion of the connection, scope will be reviewed, and a timely reconciliation process will be managed where required. | Part of connection service survey questionnaire feedback – overall score >93%. | 88% Customer Service satisfaction in regulatory year 2023/24

|

| F | For unmetered or highway connections, rent-a-jointer and post-fault re-connection services will be offered to deliver quick efficient connections (note: continuation of existing service from RIIO-ED1). | Achieve overall score >93% in customer service feedback. | 83% Highway connections satisfaction in regulatory year 2023/24

|

| G | Processes will be introduced to improve access to network capacity by actively managing interactivity queues. These will act to promote connections in an interactivity queue which allow access for others (e.g. storage) and demote slow-moving projects in favour of those ready to connect. This will be done in conjunction with other network operators as appropriate to ensure industry consistency. We will also introduce flexible connections to all customers who may benefit, further improving access to network capacity. | Processes in place, published and sign-posted in connections journey material. | 86% Satisfaction rating, three-weekly customer briefings

Associated initiatives:

|

| H | Measurement and publication of customer service feedback from quotations, connections and further associated supporting services. We will work to continually improve this feedback and evolve the scope in consultation with customers.

Supports output metric for other commitments. |

Publication of results from surveys >93% for quotations/delivery. >93% achieved for wider supporting services. |

88% Customer Service satisfaction in regulatory year 2023/24 94% Forum satisfaction 90% ‘Ask the Expert’ satisfaction 96% ‘Surgery’ satisfaction |

| I | Reduce the scope of work deemed non-contestable to further open up the connections market to competition. This will include simplification of assurance processes for ICPs to self certify design and connection work as well as increasing the areas of construction work deemed contestable. UK Power Networks will lead across the UK in reducing noncontestable electricity connections work. | Customer engagement feedback and objective evidence by comparison across DNO Connection Charging Methodology Statements. | Self design & self connect jobs submitted – % increase 22/23 to 23/24

10 new ICPs signed up to self-connect in the regulatory year 23/24 |